Accounting firms face the constant challenge of not only acquiring new clients but also retaining existing ones. Client retention is crucial for the sustainability and growth of any accounting business.

This article delves into effective client retention strategies and relationship management practices specifically tailored for accounting firms, highlighting the importance of CRM software, onboarding processes, communication techniques, and overcoming common challenges faced in client retention.

Understanding why clients might leave is crucial for firms focused on effective client retention. Some common reasons for client attrition include lack of communication, insufficient personalization, and unmet expectations. These issues can lead to client dissatisfaction and, eventually, their departure.

External factors, like mergers or financial troubles, can also affect retention rates. By identifying these potential challenges early, firms can address them proactively, ensuring clients feel valued and supported throughout their relationship.

Tip: “Regular check-ins, even when there’s no urgent issue, can help you stay connected with clients and prevent small problems from escalating.”

To address retention challenges, accounting firms should take a proactive approach to client relationship management. This means maintaining regular communication, offering personalized services, and following up consistently.

Training staff on client retention and relationship management skills can also be beneficial. By cultivating a culture that prioritizes client satisfaction, firms can build an environment where clients feel valued, which naturally enhances retention.

Note: “Fostering genuine relationships with clients is key to boosting satisfaction—retention strategies work best when clients feel truly valued. Check out more insights in our CRM guide on increasing customer satisfaction.”

Effective workflow management is key to boosting client satisfaction and retention. By streamlining processes and automating routine tasks, firms can exceed client expectations.

Workflow tools help accountants stay organized and prioritize tasks, leading to prompt responses and proactive service. Additionally, well-managed workflows reduce errors and improve efficiency, which reassures clients about their accountants’ capabilities.

By optimizing workflow management, accounting firms can create a more satisfying experience for clients, which directly impacts retention.

Tip: “Select CRM tools with adaptable workflows to streamline processes while meeting the specific needs of each client. Learn more in our guide on why accounting firms need CRM.”

Why Accounting Firms Need CRM is clear when facing the challenge of client retention. CRM software transforms client management by automating tasks and enabling personalized interactions, which streamline processes and boost client satisfaction. This section highlights how CRM can be the cornerstone of retention strategies, providing accounting firms with the tools to thrive in a dynamic market.

In accounting, retaining clients is often more cost-efficient than acquiring new ones and helps build long-lasting relationships that generate revenue through repeat business and referrals. Prioritizing client retention strengthens a firm’s client base, keeping clients satisfied and involved. Consequently, this boosts the firm’s market reputation, as happy clients are more inclined to recommend their accountants to others. Recognizing the value of client retention enables firms to employ strategies that retain current clients and attract new ones through positive recommendations.

Tip: “Start retention efforts from the very first interaction. Setting clear expectations and delivering on them helps build trust and loyalty right from the start.”

CRM software is essential for optimizing client management by automating routine tasks, enabling accountants to concentrate more on relationship-building than on administrative work. For example, CRM can automate reminders for crucial dates like tax submissions or financial reviews, ensuring clients feel supported and informed. This streamlined process not only increases productivity but also boosts client satisfaction, as clients value timely communication and proactive services. By incorporating CRM into their operations, accounting firms can establish a more organized setting that fosters improved client relations and increases client retention.

Implement CRM systems that can automate client communication, especially during peak tax seasons, to improve efficiency and client satisfaction. Discover more in our article on CRM for tax professionals.

Note: “Personalization isn’t just about knowing client names; it’s about understanding their unique needs and how you can address them.”

Personalization significantly influences client satisfaction and retention in accounting. CRM tools allow accountants to customize their interactions based on each client’s preferences and history. By analyzing client data, firms can recognize specific needs and offer tailored solutions that resonate with clients. This personalization makes clients feel appreciated and understood, which is vital for nurturing long-term relationships. Personalized services also enhance client loyalty, as clients tend to remain with firms that acknowledge and meet their unique needs.

Tip: “Leverage CRM analytics to drive actionable insights, ensuring your strategy evolves based on data, leading to better customer retention. Check out more in our guide on CRM analytics.”

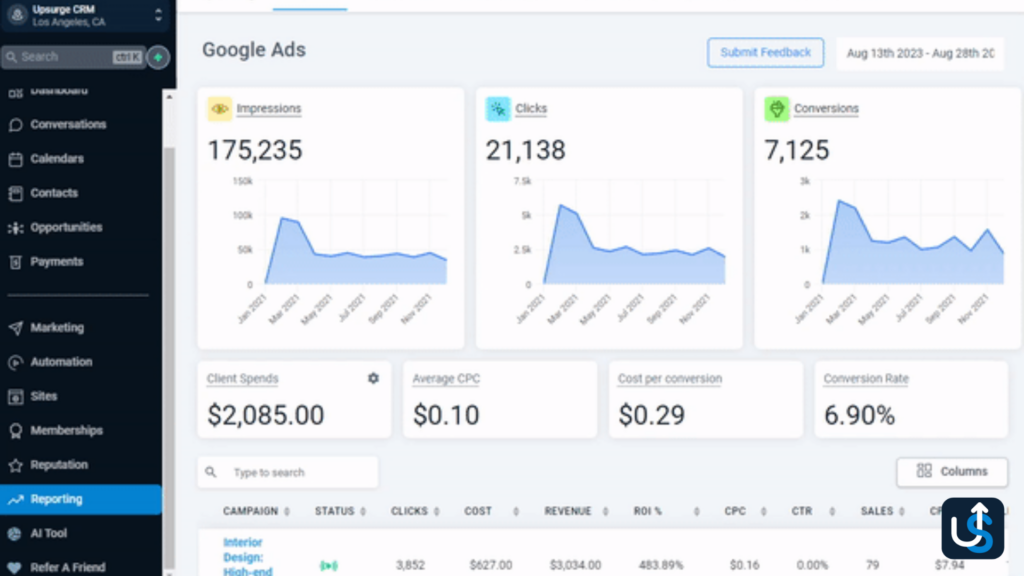

Assessing the effectiveness of client retention strategies is vital for firms to identify successful approaches and areas needing improvement. CRM systems provide analytics and reporting features that track metrics like client satisfaction surveys, retention rates, and the duration of client relationships. Using these insights, firms can refine their retention strategies and adapt to their clients’ changing needs. Regularly evaluating these metrics helps firms stay proactive with their retention efforts, ensuring they meet their clients’ evolving expectations.

The onboarding phase is crucial in the client relationship, especially for CPA firms. CRM tools can facilitate a smooth onboarding process by managing paperwork, scheduling, and follow-ups. Tailoring CRM workflows for different client types can enhance onboarding by addressing the specific needs of new versus established clients. Monitoring the effectiveness of these processes with CRM ensures continued client engagement and satisfaction, establishing a foundation for a lasting relationship.

“Ensure your client onboarding process is smooth and comprehensive, setting the foundation for long-term customer retention. Explore more about our guide on customer retention using CRM.”

CRM software plays an essential role in maintaining ongoing client communication. With CRM, firms can send regular newsletters and customized updates, keeping clients informed and engaged and demonstrating the firm’s commitment to their success. CRM-driven surveys can also gather feedback, helping firms enhance their services and boost client satisfaction, which, in turn, improves retention.

CRM software offers an array of features that can substantially improve client retention for accounting firms. These tools enable accountants to manage client data effectively, automate tasks, and analyze interactions:

Incorporating Upsurge CRM into your firm’s operations can revolutionize the way you manage client relationships. From the initial onboarding to ongoing management, Upsurge CRM equips you with the tools necessary to ensure that each client interaction is not only efficient and personalized but also deeply impactful.

Setting the right tone at the beginning of client relationships is crucial. Upsurge CRM enhances this critical phase by automating initial communications and document exchanges, ensuring the process is not only seamless but also exceptionally welcoming for new clients.

Upsurge CRM takes personalization beyond basic client management. By leveraging detailed client data collected through the CRM, your firm can customize services and communications to meet the unique needs and preferences of each client, significantly boosting client satisfaction and fostering loyalty.

Upsurge CRM stands out with its bespoke features designed specifically for the accounting sector. Here are some of the pivotal features and benefits that Upsurge CRM offers:

Client-Centric Relationship Management: Maintain comprehensive client profiles that include communication history and preferences, fostering personalized interactions that build trust and enhance satisfaction.

Efficient Client Segmentation and Categorization: Classify your clients based on criteria such as industry or service type, enabling more focused and effective communication strategies.

Advanced Communication Tools: Employ Upsurge CRM’s advanced tools to send customized messages and updates, keeping your clients engaged and well-informed about relevant developments and insights.

Project Tracking and Analytics: Monitor project progress and gauge client satisfaction using sophisticated analytics, facilitating data-driven enhancements in your service delivery.

Task and Deadline Management: Manage deadlines and client tasks with automated reminders from Upsurge CRM, ensuring meticulous attention to detail.

Document Management and Collaboration: Quickly share and access crucial documents and financial reports, which improves client interactions and boosts team collaboration.

Billing and Invoicing Integration: Streamline your billing processes by integrating Upsurge CRM with your existing accounting systems, centralizing your financial interactions.

Client Feedback and Satisfaction Monitoring: Implement effective feedback mechanisms to capture valuable client insights, which are essential for ongoing improvement and enhanced retention.

Custom Reporting and Insights: Generate customized reports to uncover critical insights, helping to refine your strategies and improve client satisfaction.

By leveraging Upsurge CRM, your accounting firm can not only meet but exceed the expectations of your clients, ensuring long-term retention and success in a competitive marketplace.

Effective client retention is essential for sustaining growth and building a durable business. CRM software provides a robust framework for enhancing relationship management, enabling firms to manage client interactions more effectively from onboarding to ongoing engagement. With the right CRM tools, accounting firms can automate routine tasks, personalize client services, and ensure timely communication.

For more information on how Upsurge CRM for Accounting Firms can transform your accounting firm, Contact us today!