The integration of CRM systems into the tax profession represents a transformative shift, enabling tax professionals to manage their client information with unprecedented efficiency, accuracy, and security. Incorporating a CRM system into your practice means embracing a future where you can offer more personalized, secure, and efficient services to your clients.

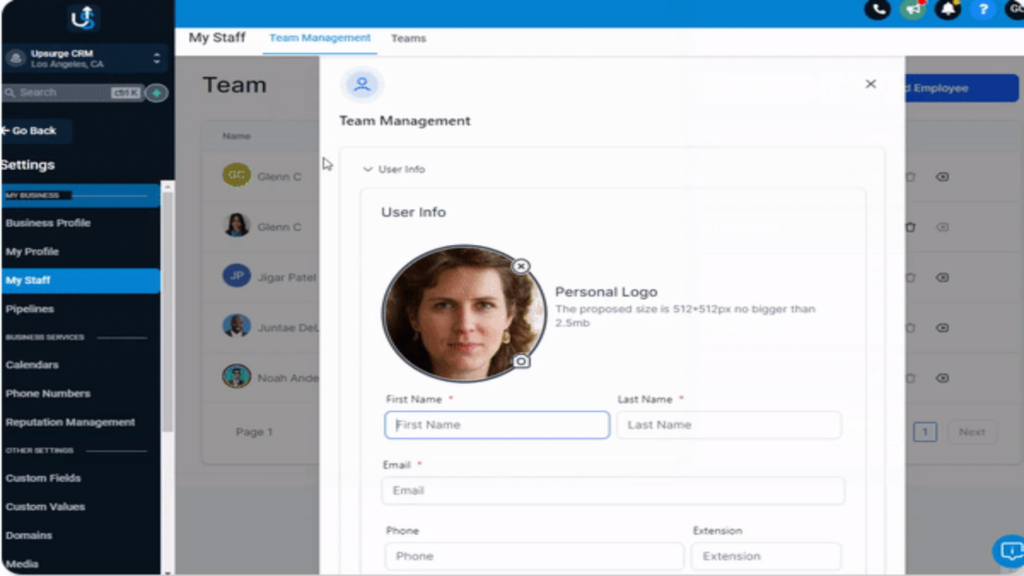

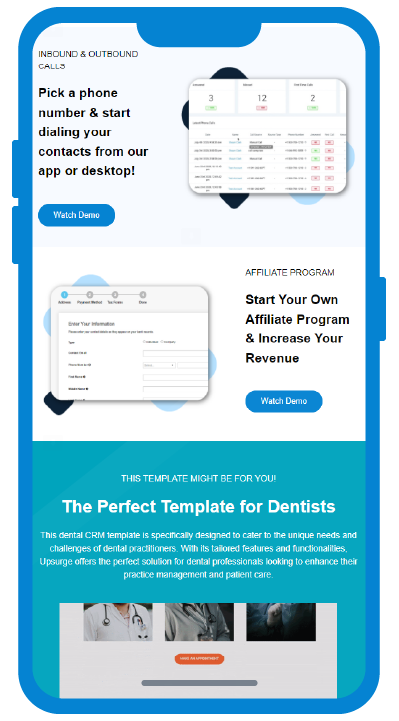

With its client-centric features and intuitive interface, UpsurgerCRM is designed to meet the unique challenges and requirements of the tax industry. By choosing UpsurgerCRM, you’re choosing a partner committed to your growth and your client’s satisfaction.

Embrace the future of tax professionalism with UpsurgerCRM. Visit us to learn more, see a demo, or start your journey toward unparalleled client relationship management. Experience UpsurgerCRM—where innovation meets client satisfaction, and where your practice can reach new heights.