As a financial advisor, your ability to convert leads into clients is integral to the growth and sustainability of your practice. The modern marketplace brims with tools designed to facilitate this critical process, and among those, Customer Relationship Management (CRM) systems stand out as a particularly powerful ally. With industry studies showing that CRM can improve conversion rates by up to 300%, it’s clear why savvy financial advisors are turning to CRM solutions to gain an edge. Here is a detailed exploration of how CRM can specifically enhance lead conversion rates for financial advisors.

In the journey from prospect to client, financial advisors face the critical task of lead conversion—a process where efficiency and personalization become key. CRM software steps in as an invaluable asset for financial advisors, serving a multifaceted role that not only simplifies lead management but also enhances the chances of conversion at every step. By providing a structured system for tracking interactions, analyzing lead behavior, and facilitating effective communication, CRMs allow advisors to focus on what they do best: providing top-notch financial advice tailored to individual client needs.

The necessity of a CRM system stems from its ability to systematically manage and nurture leads through the sales pipeline. With a CRM, advisors gain deep insights into client behavior and preferences, which is crucial for customizing communication and services to align with individual client profiles.

Furthermore, CRM software equips advisors with the tools to score and prioritize leads, ensuring that their time is invested in the most promising prospects. Automated follow-ups and reminders within the CRM help maintain consistent engagement without the manual overhead. This level of efficiency and personalization ultimately leads to higher conversion rates.

Financial advisors aiming to enhance their lead conversion rates can employ several CRM-driven strategies that leverage the powerful features of CRM software. Here are some result-oriented strategies that can be integrated into a financial advisor’s practice using a CRM system:

Utilize your CRM’s lead-scoring capabilities to rank prospects based on their likelihood to convert. Assign points for different interactions and behaviors, such as website visits, webinar attendance, or engagement with emails. This approach allows financial advisors to focus on high-priority leads that show a greater interest in their services, thereby optimizing their time and conversion efforts.

Use the data within your CRM to segment your audience and tailor communications to the specific needs and interests of each lead. Addressing clients by name, acknowledging their financial goals, and providing relevant information can significantly increase engagement and move leads closer to conversion. Personalized emails are known to deliver six times higher transaction rates, according to Experian.

Design automated workflows to send timely and relevant content to leads at each stage of the funnel. Whether it’s educational material, market updates, or a simple check-in, automated nurturing keeps your advisory top of mind. CRM systems can help maintain a consistent nurturing schedule, which is essential as nurtured leads produce, on average, a 20% increase in sales opportunities (DemandGen).

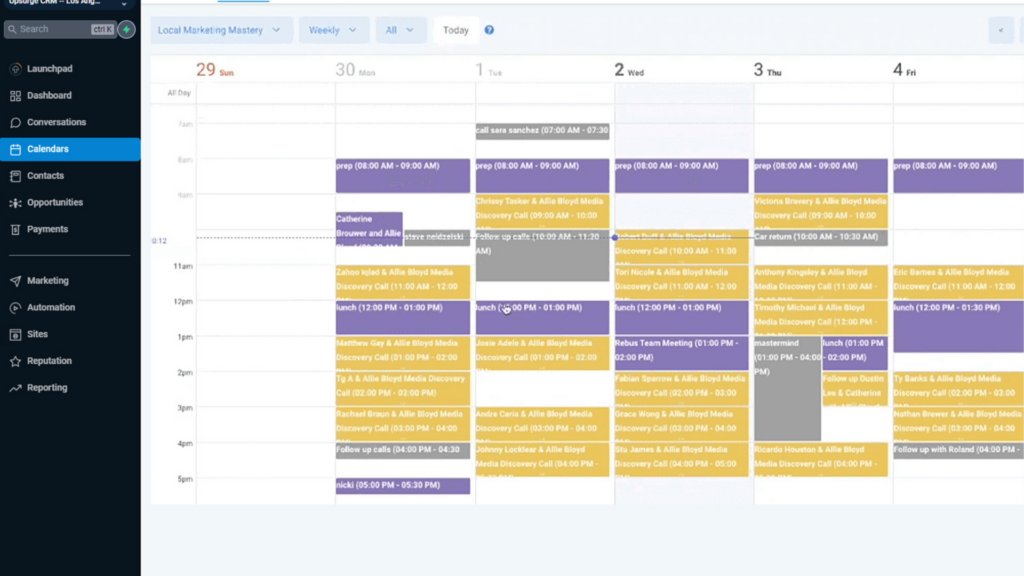

Incorporate scheduling tools within your CRM to simplify the appointment-setting process for leads. By allowing leads to book meetings directly through the CRM platform, advisors can reduce friction and make it easier for interested prospects to engage with their services, ultimately increasing conversion opportunities.

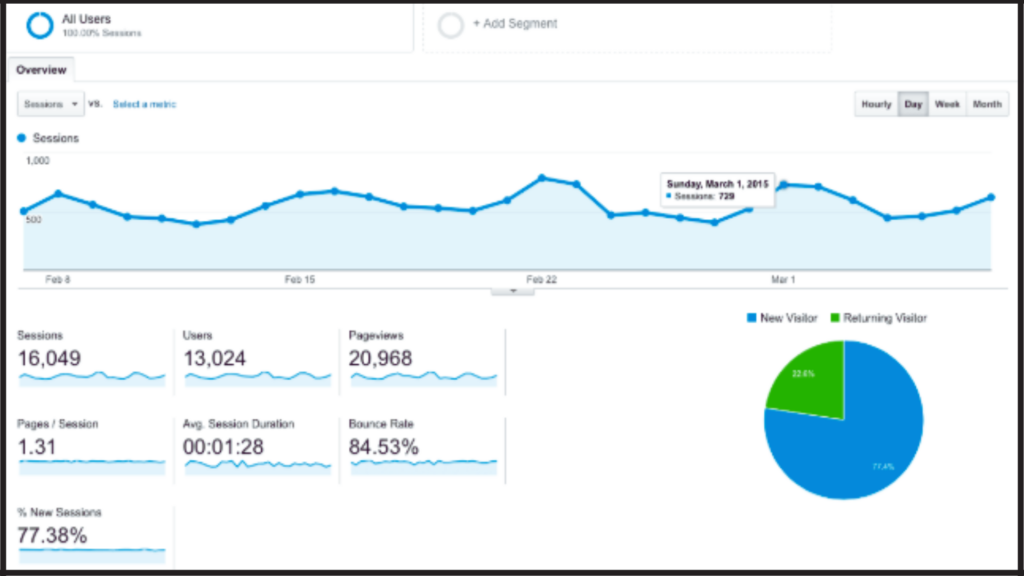

CRMs provide a wealth of analytics that can be used to track conversion rates and identify the most effective tactics. Regularly analyze these metrics to understand what’s working and what’s not. A/B testing different messages, subject lines, and calls to action can provide valuable insights for continuously improving conversion strategies.

Quick response times can be the difference between a lead going cold or converting into a client. CRM software can prompt advisors to follow up with leads shortly after an initial inquiry or interaction. Studies have highlighted that the odds of converting a lead decrease as the response time increases, so leveraging CRM prompts for timely responses can have a significant impact on conversion rates.

Use your CRM to ensure that marketing campaigns align with the sales team’s efforts. Sharing leads’ engagement data between departments allows for a cohesive strategy and messaging, which helps in presenting a unified front to potential clients. Strong alignment between sales and marketing can lead to 38% higher sales win rates, according to MarketingProfs.

By adopting and adapting these CRM strategies, financial advisors can not only increase their efficiency but also significantly boost their lead conversion rates. A well-utilized CRM system is a game-changer for advisors who want to scale their client base and enhance their practice’s profitability.

The competitive landscape for financial advisors demands tools that not only save time but also sharpen the precision of client engagement. UpsurgeCRM emerges as the specialized solution that addresses the unique challenges faced by financial advisors in lead conversion.

The first step toward increasing lead conversion is knowing where to focus. UpsurgeCRM’s intricate lead-scoring metrics zero in on user behavior, enabling advisors to identify the warmest leads. By assigning values to actions such as opening an email or attending a seminar, UpsurgeCRM helps you prioritize your pipeline, ensuring that you direct your energy to the leads that are most likely to convert. This targeted approach is a more efficient use of resources, increasing the overall conversion rate.

Consistency is key in cultivating leads, and UpsurgeCRM’s automation features enable persistent yet personalized follow-ups without overburdening advisors with administrative tasks. The system can be set up to send customized email sequences based on triggers like downloading a whitepaper or signing up for a newsletter, keeping your services top-of-mind for potential clients. This automation of touchpoints ensures that no lead is neglected and increases the chances of conversion.

Data speaks volumes, and understanding it can significantly enhance conversion success. UpsurgeCRM comes equipped with powerful analytics that provides real-time insights into your sales process. With these insights, financial advisors can pinpoint effective tactics, identify areas that need improvement, and adjust their strategies accordingly. This might mean refining the timing of communications, altering messaging to better appeal to certain segments, or doubling down on the most lucrative lead sources.

UpsurgeCRM’s integration with calendar and scheduling tools simplifies the process for leads to move down the funnel. By enabling prospects to seamlessly book appointments or consultations, the system removes barriers and friction that can often prevent a lead from becoming a client. This ease of access not only enhances the user experience but also demonstrates the advisor’s commitment to convenience and accessibility.

Financial advisors who embrace CRM systems are equipped to increase their lead conversion rates and build a more sustainable, profitable practice. By understanding client needs, streamlining lead management, automating follow-up processes, harnessing data insights, and fostering referral networks, a CRM tailored for financial advisors becomes an indispensable tool.

By harnessing the tailored functionalities of UpsurgeCRM, financial advisors can optimize their lead conversion process, creating a more targeted, efficient, and client-centric approach. The specialized features inherent to UpsurgeCRM are designed to align with the financial advisor’s need for a sophisticated yet intuitive lead conversion strategy.

Ready to transform your lead conversion approach? Explore UpsurgeCRM and uncover the potential of a CRM solution crafted for financial advisors. Connect with us today and take the first step towards a more profitable practice with higher conversion rates.

The Real Benefits of Contact Management with CRM for Collecting Customer Data Managing and leveraging customer information has become a foundational aspect of success…

Can a CRM Really Automate My Sales Follow-Ups and Boost My Small Business Revenue? Small businesses face increasing pressure to maintain consistent communication with…

Best CRM Software for Sales Prospecting: Transform Your Sales Prospecting Struggling to turn cold leads into paying customers? You’re not alone. In today’s competitive…