Are unmanaged risks in your project portfolio costing you time and money?

Project portfolio risk management is a critical strategy that helps organizations identify, analyze, and respond to risks across all their projects. By taking a bird’s-eye view of your portfolio, you can mitigate risks, align resources with business goals, and maximize returns. In this blog, we’ll explore why portfolio risk management matters, how to implement it, and how Upsurge CRM can help you save money while improving outcomes.

According to PMI’s Pulse of the Profession report, organizations that prioritize portfolio risk management are 27% more likely to meet their financial goals and deadlines compared to those that don’t.

Portfolio risk management is the process of overseeing and mitigating risks across a company’s entire project portfolio. Unlike project-level risk management, which focuses on individual projects, portfolio risk management takes a macro approach, ensuring that every project aligns with strategic goals and contributes to organizational success.

A project portfolio includes all projects and programs within an organization that are aligned with its strategic objectives. It provides a comprehensive overview of all initiatives, allowing decision-makers to evaluate how each project contributes to broader organizational goals.

For instance, a company’s project portfolio might encompass technology upgrades, product launches, operational improvements, and marketing campaigns. By consolidating these diverse initiatives, organizations can prioritize resources, ensure alignment with strategy, and address potential overlaps or conflicts.

Risks in project portfolios encompass a variety of challenges that can impact the success of initiatives. These include:

Technical Risks: Issues related to technological feasibility, system integration, or unexpected software failures.

Organizational Risks: Internal challenges such as resource constraints, communication breakdowns, or changes in leadership.

External Risks: Factors outside the organization’s control, such as market volatility, regulatory changes, or supply chain disruptions.

Project Management Risks: Risks stemming from inadequate planning, unclear objectives, or poor execution.

Understanding these risks at the portfolio level allows organizations to implement proactive measures, mitigating their impact and enhancing the likelihood of project success.

Why It Matters: Unmanaged risks can lead to delays, increased costs, and resource misallocation. Effective portfolio risk management enables businesses to mitigate these issues and protect their bottom line. By doing so, organizations not only safeguard resources but also position themselves for greater market competitiveness.

Enhanced Decision-Making: Identify opportunities and threats across the portfolio to make data-driven choices that directly impact profitability.

Optimized Resource Allocation: Avoid wasting resources on low-priority projects by aligning efforts with high ROI opportunities.

Strategic Alignment: Ensure every project supports long-term business objectives, increasing the likelihood of financial success.

Increased Stakeholder Confidence: Demonstrate a proactive approach to handling uncertainties, earning trust from clients and investors.

Agility and Flexibility: Adapt quickly to changes and unforeseen events, reducing financial surprises and enabling smoother transitions.

To maximize ROI, evaluate risks in terms of both short-term impact and long-term implications. Sometimes, minor risks today can snowball into costly issues in the future.

Start by leveraging CRM tools to systematically identify risks across your project portfolio. Use built-in analytics to assess complexity, technological challenges, market dynamics, and resource availability in real-time.

With Upsurge CRM, you can integrate data from multiple projects, giving a comprehensive view of potential risks. Utilize features like automated trend analysis and predictive risk modeling to anticipate issues before they arise.

Engage stakeholders and use tools like SWOT analysis to uncover potential challenges and opportunities. A Gartner study shows that companies using structured risk identification tools experience 40% fewer project failures.

Involve team members from different departments during risk identification. Cross-functional input often uncovers risks that are overlooked in siloed environments.

After identifying risks, CRM software helps you quantify their likelihood and potential impact. Tools like Monte Carlo simulations and risk heat maps provide data-driven risk assessments, allowing you to prioritize high-impact risks effectively.

Practical Example: Upsurge CRM’s scenario analysis feature allows teams to simulate different outcomes based on resource availability and market conditions, helping decision-makers allocate resources efficiently. Use quantitative methods like Monte Carlo simulations or qualitative assessments to prioritize high-impact risks. This helps you focus your efforts where they’ll deliver the most value.

Use CRM automation to create structured risk mitigation plans. Assign risk owners, allocate necessary resources, and set timelines directly within the CRM platform. Automated task tracking ensures that risk mitigation steps are followed through in a timely manner.

Always assign a “risk owner” for every identified risk. This ensures accountability and faster resolution. Risk owners should have the authority to act swiftly and the expertise to address the challenges effectively.

With Upsurge CRM, workflows can be customized to trigger automatic alerts when a risk threshold is breached, keeping project teams proactive and reducing costly delays. Assign responsibilities, allocate resources, and set realistic timelines. By addressing risks proactively, you’ll save money and ensure smoother project execution.

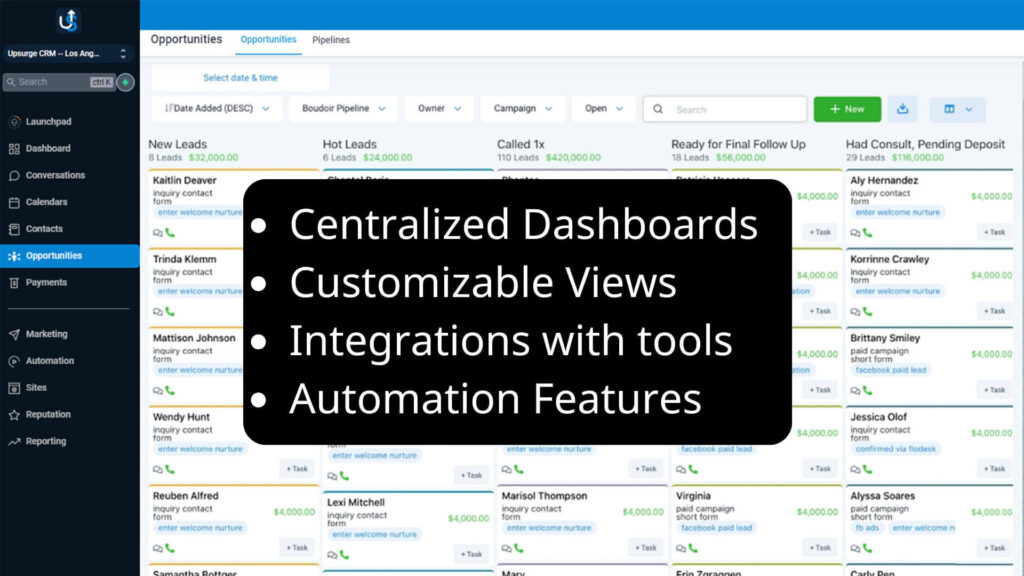

Continuous monitoring is essential for effective risk management. CRM dashboards provide real-time visibility into project status, emerging risks, and performance trends. Automated reporting ensures that teams receive up-to-date risk insights without manual effort.

Regular risk reviews can reduce unexpected project costs by up to 30%, as per Deloitte’s risk management survey. Frequent reviews ensure the dynamic nature of risks is captured and managed.

Use real-time data from Upsurge CRM dashboards to identify emerging risks and adjust plans accordingly.

Upsurge CRM is your go-to solution for simplifying and optimizing project portfolio risk management. With its cutting-edge tools and features, Upsurge CRM provides a comprehensive approach to managing risks effectively, ensuring your projects stay aligned with strategic goals and deliver maximum ROI.

Centralized Dashboards: Track all your projects in one place with real-time updates, helping you identify risks early.

Customizable Views: Gain insights into bottlenecks, resource allocation, and overall financial health.

Automation: Receive automated alerts for deadlines, project status changes, and potential risk triggers, ensuring you’re always in the loop.

Integrations: Seamlessly connect with your existing tools to streamline workflows and improve efficiency.

Use Upsurge CRM’s reporting features to analyze trends over time. This historical data can help predict future risks and improve long-term planning.

Reduce Costly Delays: Early identification of risks prevents expensive project overruns. For example, timely detection of supplier delays allows for adjustments that avoid penalties.

Boost ROI: Focus resources on high-priority projects to maximize returns. Projects aligned with strategic goals deliver better financial outcomes.

Increase Profitability: Proactively managing risks protects your margins and ensures consistent results.

Project portfolio risk management is essential for modern businesses aiming to optimize resources, align with goals, and boost profitability. By gaining a holistic view of your portfolio, you can mitigate risks and move forward confidently.

Don’t let risks derail your success. Take control today. Start your risk-free trial of Upsurge CRM and experience seamless, intelligent project portfolio management firsthand. aiming to optimize resources, align with goals, and boost profitability. By gaining a holistic view of your portfolio, you can mitigate risks and move forward confidently.

Ready to save time and money with smarter project management? Start your risk-free trial of Upsurge CRM today and leave unnecessary risks behind.