Every connection, interaction, and decision holds the potential to secure or miss out on the next groundbreaking investment. With a multitude of deals constantly in play, effectively managing the deal flow and nurturing strong relationships are essential to maintaining a competitive edge.

A Venture Capital CRM (Customer Relationship Management) system revolutionizes this process by offering specialized tools for managing investor relations, tracking investment opportunities, and enhancing decision-making.

This blog will explore the vital role of venture capital CRMs in optimizing pipeline management, discuss the essential features that make them invaluable, and review the best software options available, including Upsurge CRM—a robust solution specifically crafted to meet the evolving needs of venture capital professionals.

A Venture Capital CRM is a specialized software solution tailored to meet the unique needs of venture capital firms. Unlike general-purpose CRM systems, a CRM designed for venture capital focuses on managing investor relations, tracking deal flow, and facilitating communication between venture capitalists and potential portfolio companies.

Over 75% of venture capital firms have adopted CRM solutions specifically tailored to their needs, with an estimated 40% reporting significant improvements in operational efficiency within the first year of implementation.

When choosing a venture capital CRM, it’s crucial to consider the key features that will support your firm’s unique needs. Research indicates that nearly 85% of VC firms prioritize specific functionalities such as deal management and contact management when selecting a CRM platform. Leading venture capital CRM software typically includes:

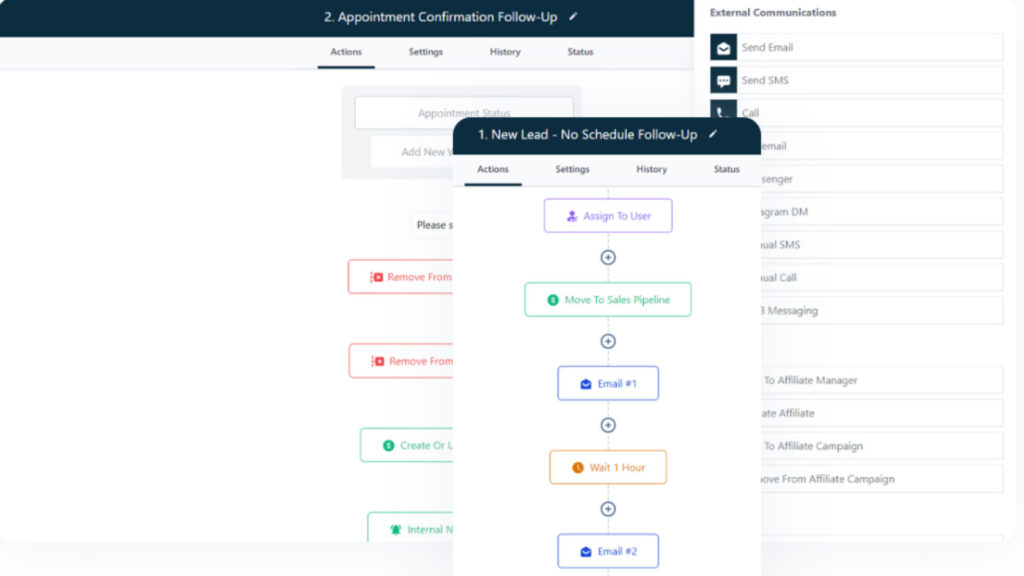

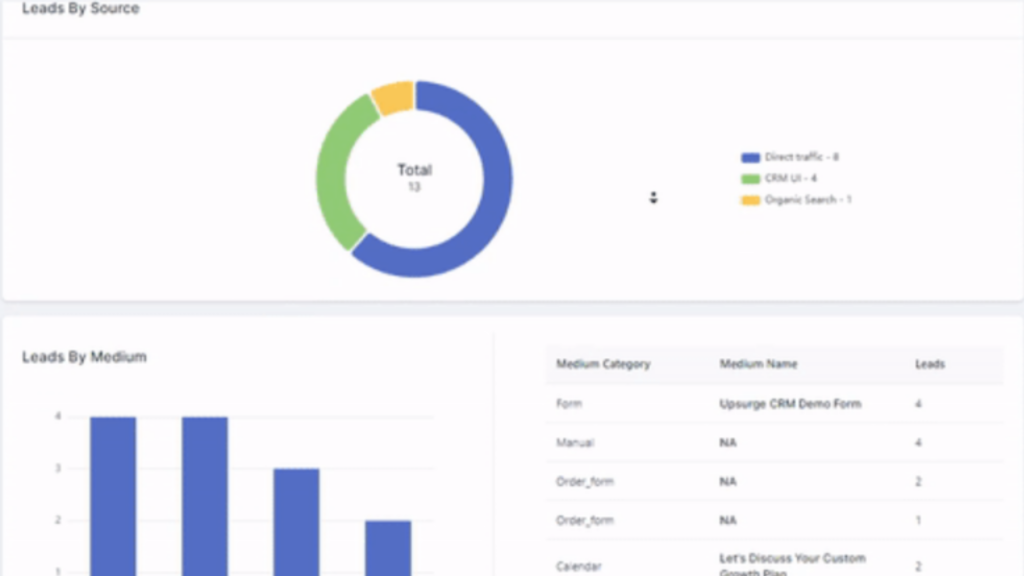

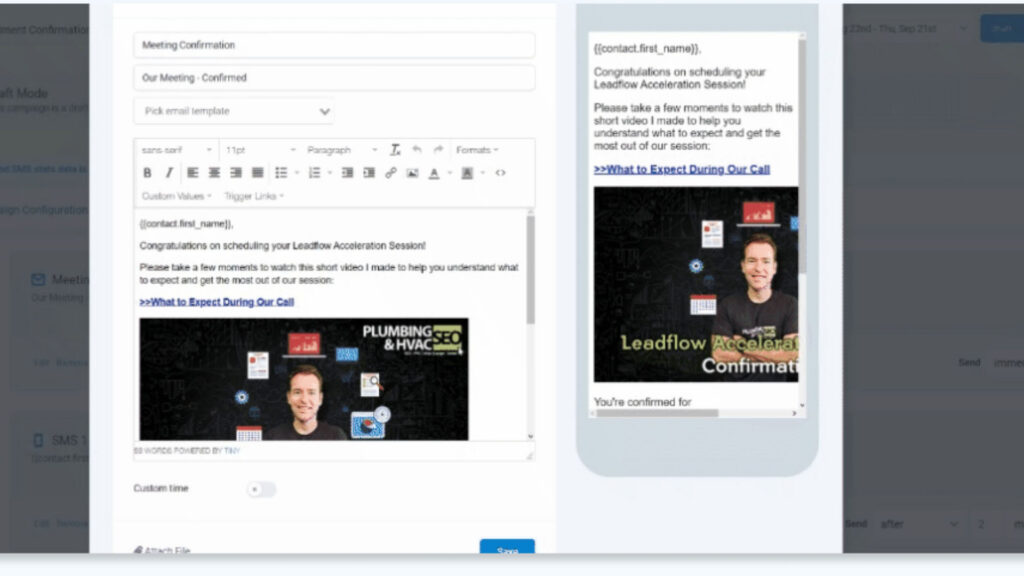

Deal flow management is crucial for venture capital firms, and a VC CRM enhances this process by automating many tasks related to tracking potential investments. By centralizing all deal-related information, the platform ensures efficient communication and alignment among team members.

It also enables the tracking of interactions with potential portfolio companies, allowing professionals to identify trends, prioritize opportunities, and make data-driven decisions. Ultimately, a venture capital CRM serves as a comprehensive solution for managing deal flow, improving transparency, and increasing the efficiency of investment operations.

Pipeline management in venture capital is a systematic approach to tracking, evaluating, and nurturing potential investment opportunities. Effective pipeline management allows VC firms to prioritize the most promising deals and allocate resources where they will have the most impact. This approach helps firms forecast future investment decisions and create strategies for engaging with promising startups.

A well-managed pipeline can significantly increase the chances of successful investments and, ultimately, contribute to the overall success of the venture capital firm. Notably, research shows that firms with effective pipeline management practices have a 25% higher success rate in closing deals compared to those without a structured approach.

To ensure effective pipeline management, venture capital firms should adopt the following best practices:

Implementing these practices can increase a firm’s deal flow by 30% or more, according to industry reports.

CRM solutions specifically designed for venture capital can significantly enhance pipeline management by:

Research indicates that firms using CRM solutions specifically tailored for venture capital experience a 40% increase in efficiency and a 20% reduction in deal cycle times, highlighting the transformative impact of these tools on pipeline management.

Relationship intelligence refers to the insights and analytics derived from the network of contacts and interactions within a venture capital firm. This intelligence can significantly benefit VC teams by enabling them to understand their connections better, identify potential co-investors, and leverage relationships for sourcing deals.

By harnessing relationship intelligence, firms can strategically engage with their network, leading to more fruitful investment opportunities and enhanced collaboration between venture capitalists and their portfolio companies.

Integrating relationship intelligence into a CRM tool can optimize the way venture capital firms manage their networks. Many modern CRM solutions offer features that allow users to track interactions, assess connection strength, and identify key relationship dynamics within their network.

By utilizing these capabilities, VC teams can prioritize their outreach efforts, nurture valuable connections, and ultimately enhance their deal-sourcing and investment decision-making processes. This integration ensures that relationship intelligence becomes an intrinsic part of the CRM platform, empowering venture capital firms to maximize their potential in the capital market.

Understand Your Firm’s Needs: Identify specific challenges in deal flow, investor relations, and team collaboration. Consider factors like firm size, investment strategy complexity, and integration needs to select a CRM that aligns with your goals.

Balance Cost vs. Value: Evaluate CRM solutions based on their cost and the value they bring. High-priced options might offer advanced features for better deal management, while free versions may lack the necessary tools for venture capital requirements.

Prioritize Integration and Scalability: Choose a CRM that integrates seamlessly with existing tools and can scale as your firm grows. This ensures smooth workflows and adapts to increasing deal volumes or new investment strategies, providing long-term value.

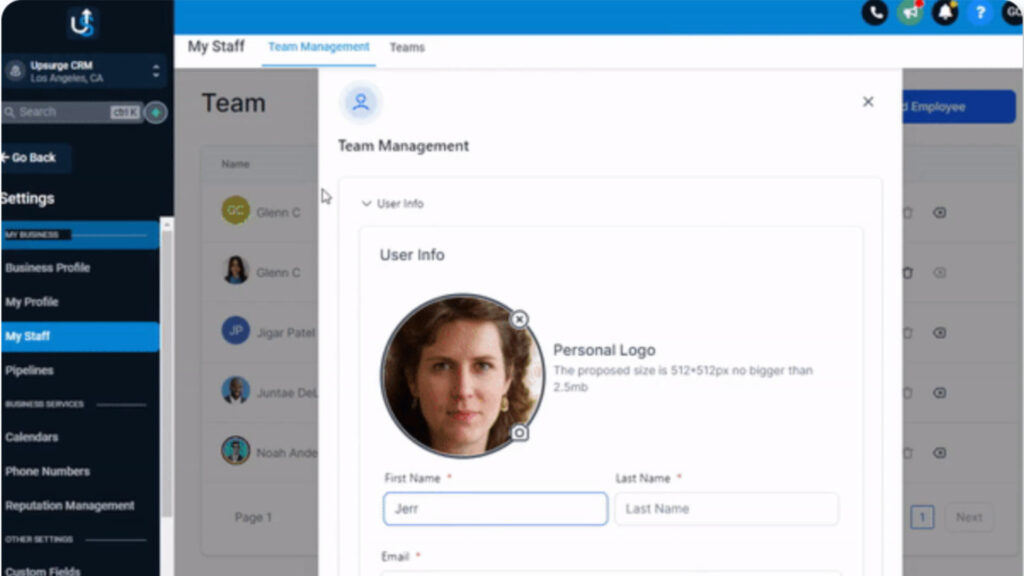

In the competitive landscape of venture capital, having a reliable venture capital CRM system is essential to managing deal flow, nurturing relationships, and making informed investment decisions. Upsurge CRM stands out as a powerful solution tailored specifically for the needs of venture capital firms, offering a range of features designed to enhance operational efficiency and drive successful outcomes.

While there are many CRM options available, Upsurge CRM stands out for its ability to cater specifically to the needs of venture capital firms. With features that are tailored to enhance deal flow management, investor relations, and overall operational efficiency, Upsurge CRM is a valuable asset for any VC firm looking to stay competitive in a dynamic market.

In venture capital, the right CRM can transform how you manage deal flow, nurture relationships, and make smarter investment decisions. Upsurge CRM offers a powerful, tailored solution designed to meet these specific needs, helping you track investor interactions, monitor startup progress, streamline communication, and leverage data for strategic advantage.

Don’t let valuable opportunities slip through the cracks. Optimize your operations, enhance collaboration, and drive success with Upsurge CRM. Ready to take your firm to the next level? Contact us today to learn how Upsurge CRM can make a difference.