Choosing the appropriate Customer Relationship Management (CRM) software in the venture capital sector goes far beyond basic administrative tasks; it’s a strategic decision of considerable importance. A CRM that’s specifically designed for venture capital isn’t merely a tool but a vital component that greatly influences the efficiency, strategic effectiveness, and overall success of a venture capital firm.

This blog delves into the crucial factors that venture capital firms need to consider when choosing a CRM, highlighting the unique features that make a CRM platform not just functional but exceptional for the venture capital industry.

Before embracing a CRM solution, it’s imperative for a venture capital firm to delineate its unique requirements, ensuring the chosen system is not just a generic CRM, but one that aligns with the specific dynamics of the VC market.

Workflow and Process Integration: Venture capital professionals need a CRM that seamlessly integrates into their existing workflow. This means choosing a CRM that offers not just basic customer relationship management software functionality, but one that is designed for VC, potentially cloud-based, and capable of adapting to the fast-paced and complex nature of the VC world. Consider whether the CRM can streamline your processes, from deal sourcing to investment decisions, thereby enhancing your management process.

Pipeline Management: An effective pipeline management process is a cornerstone for any VC firm. The right CRM should offer comprehensive pipeline management tools, enabling you to track investment opportunities, manage deal flow, and understand your capital deployment at a glance. Look for a CRM that offers, beyond traditional CRM capabilities, a specialized focus on the needs of venture capital, like Upsurge CRM, known for its robust pipeline management features.

Data Entry and Management: In the venture capital sector, where data drives decisions, a CRM must minimize the need for manual data entry while ensuring data accuracy and accessibility. This is where cloud-based CRM, offers automated data capture and intelligent data management tools. These features not only streamline data entry but also facilitate informed investment decisions and efficient portfolio management.

Relationship Intelligence: For venture capitalists, the strength of their network can make a significant difference. A CRM built for venture capital should encompass advanced relationship management platforms, enabling you to leverage your relationships with investors and portfolio companies effectively. Such a CRM should provide insights that help venture capital teams identify and capitalize on investment opportunities, fostering long-term relationships with key stakeholders.

When selecting the best CRM software for venture capital, it’s essential to focus on a CRM solution that is not just a generic customer relationship management platform, but one specifically designed for the unique needs of venture capital professionals. Here are the key features to look for:

Comprehensive Deal Flow Management: The ideal venture capital CRM software should provide advanced tools for managing every aspect of a venture capital deal. This includes everything from initial contact and deal sourcing to due diligence and deal closure, facilitating a streamlined management process.

Pipeline Visualization: An effective VC CRM must offer a clear visualization of the investment pipeline. This is crucial for venture capitalists to make informed decisions, track ongoing deals, and assess potential opportunities. Tools that allow for this kind of visualization help in efficiently deploying capital and managing the deal flow process.

Automated Data Entry: In the fast-paced venture capital environment, reducing manual data entry is key. The best CRM for VC will feature automation capabilities to ensure data accuracy, thereby saving time and enhancing portfolio management. This feature is particularly important for VC firms that manage large volumes of data.

Customizable Workflow: Every venture capital firm has unique needs. A CRM system designed for venture capital should offer customizable workflows and processes, allowing firms to tailor the software to their specific requirements. This flexibility is a hallmark of the best CRMs for venture capital, differentiating them from traditional CRM systems.

Seamless Integration with Other Tools: Top venture capital CRMs should integrate effortlessly with other popular CRM tools and management platforms. This integration capability allows for a more cohesive management experience and supports a range of functions from contact management to relationship intelligence.

Investment and Portfolio Management: An ideal CRM for venture capital firms should not only aid in managing investments but also provide comprehensive portfolio management features. This includes tracking investment performance, overseeing portfolio companies, and supporting venture capital teams in making strategic decisions.

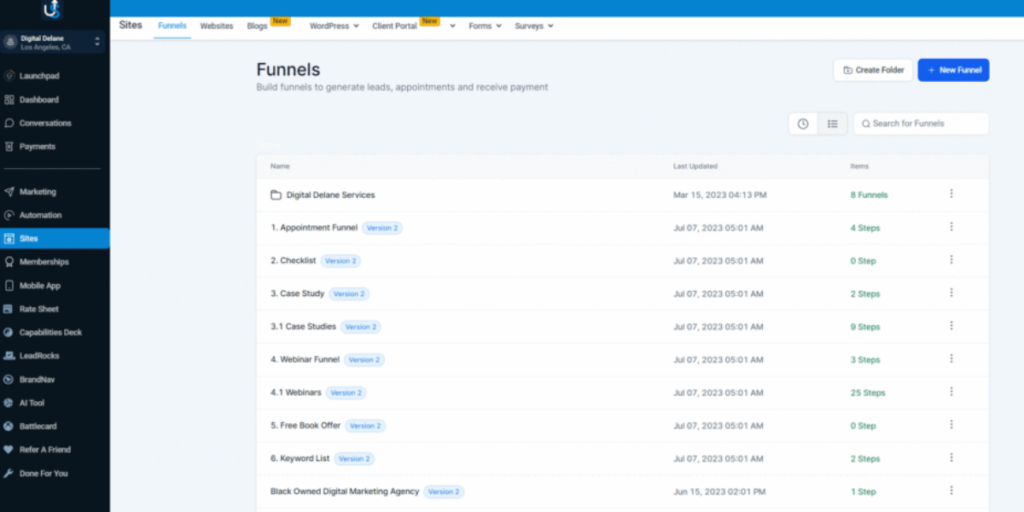

At Upsurge CRM, we’ve established ourselves as a specialized CRM solution uniquely designed for venture capital. Our platform stands out for its tailored features and tools that specifically cater to the intricate requirements of VC firms. Here’s why it stands out:

We understand the specific needs of the venture capital market. That’s why we’ve designed Upsurge CRM to support the complex processes of VC investment, from deal management to investment execution. Our comprehensive deal management, due diligence facilitation, and advanced relationship intelligence are all aimed at empowering firms in their investment journey.

Our platform excels in optimizing deal sourcing and managing deal flow, crucial for active firms. We provide tools that aid in identifying potential investment opportunities and tracking these prospects through the investment process. This ensures that our clients can manage their deal flow with utmost efficiency.

Understanding the diverse needs of venture capital firms, Upsurge CRM integrates seamlessly with popular tools and offers extensive customization options. This flexibility allows our clients to tailor the CRM to their specific workflows and processes, ensuring efficiency and effectiveness in their operations.

Recognizing the pivotal role of relationships in venture capital, we’ve equipped Upsurge CRM with advanced contact management tools. These tools are instrumental in forging and nurturing strong relationships with portfolio companies and investors, which is essential for successful venture capital operations.

We support the entire investment management process. Our CRM offers features to effectively manage investments, track investment performance, oversee portfolio companies, and provide insights for informed decisions.

Our versatility extends beyond venture capital, catering to industries like gyms, health coaches, fundraising, law firms, and more. This capability to handle diverse business requirements is beneficial for venture capital firms with varied investment portfolios.

At Upsurge CRM, we pride ourselves on being a comprehensive and specialized solution for venture capital firms. Our platform is designed to streamline venture capital processes, enhance relationship management, and support informed investment decisions. Our focus on customization, integration, and industry-specific needs makes us a robust platform for venture capital professionals.

For more detailed insights into our capabilities and to see how we can assist your venture capital firm, we invite you to visit our official website.

Choosing the right CRM for your venture capital firm involves understanding your specific needs and evaluating how different CRM systems align with those needs. The best CRM will offer a comprehensive solution for managing your VC deals, portfolio companies, and investor relationships. Upsurge CRM stands out as a tailored option for firms between other competitive venture capital CRM platforms like Salesforce, Hubspot CRM, Pipedrive CRM, Zoho CRM, and Affinity.

Discover how Upsurge CRM helps you elevate your firm’s success. Our platform not only helps streamline deal flow and enhance relationship management but also offers insightful analytics to guide your investment decisions. Experience the transformative power of a CRM designed specifically for venture capital. Visit us at Upsurge CRM to learn more and start your journey toward efficient and effective venture capital management.

The Real Benefits of Contact Management with CRM for Collecting Customer Data Managing and leveraging customer information has become a foundational aspect of success…

Can a CRM Really Automate My Sales Follow-Ups and Boost My Small Business Revenue? Small businesses face increasing pressure to maintain consistent communication with…

Best CRM Software for Sales Prospecting: Transform Your Sales Prospecting Struggling to turn cold leads into paying customers? You’re not alone. In today’s competitive…